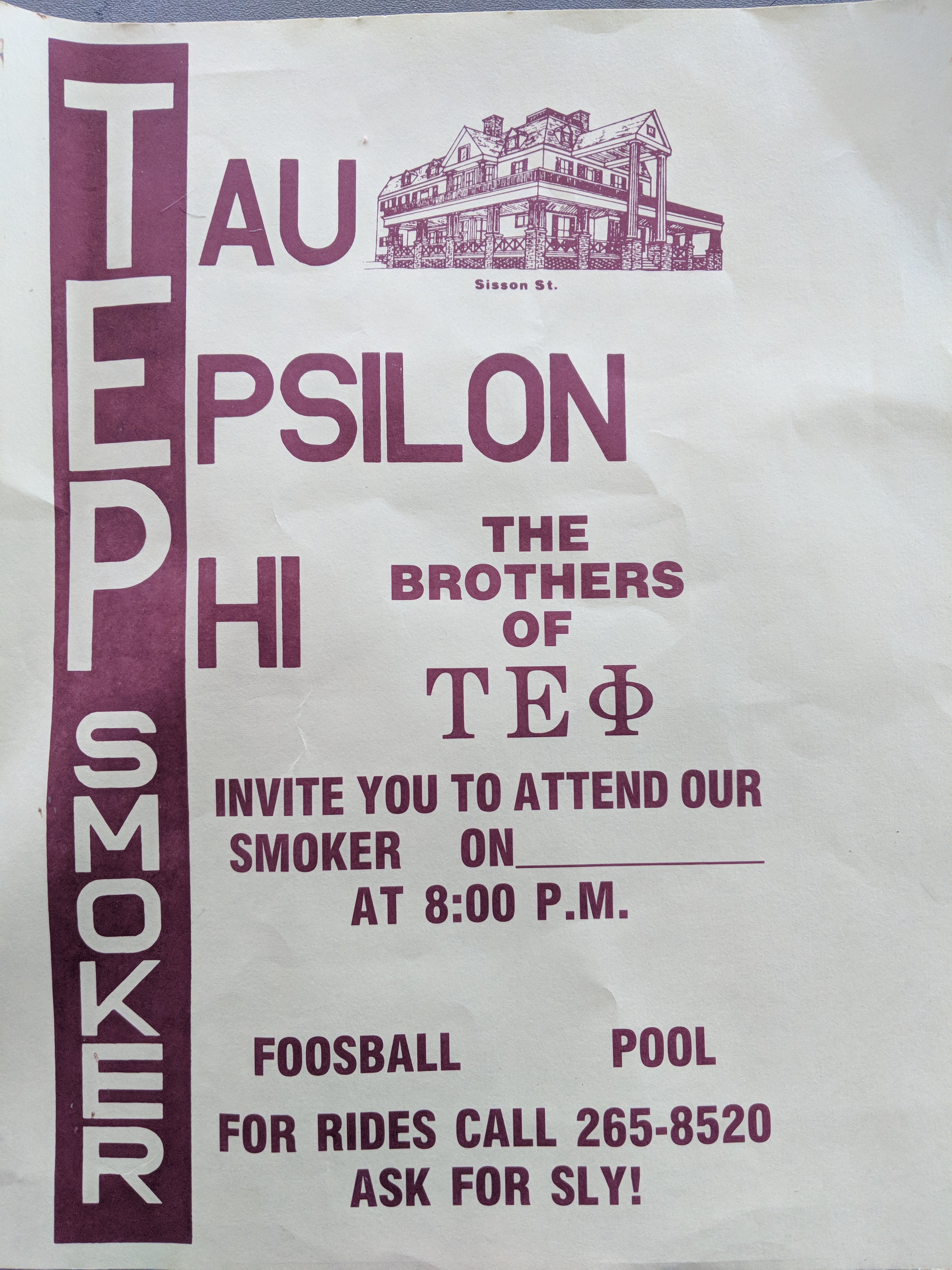

LPEAA purchased the property from ΤΕΦ National in 1997. A group of alumni invested money into a company (JRS) and the money was used for the purchase. LPEAA has maintained the house since.

Is there a mortgage on the property?

Yes. There are 2 years left until the current mortgage is paid off in full.

Is my donation tax deductible?

No. While LPEAA is tax exempt, we do not have “charitable” status for deductible donations.

How do I make a recurring donation?

PayPal is being used for recurring donations. The donation will automatically be drawn from your account monthly/yearly and transferred to LPEAA.

Who will manage the Endowment Fund?

LPEAA will keep donations in a separate account until we reach $50K. After that, we will engage a qualified financial firm to handle management and investment. The LPEAA Board will report on the progress of the fund yearly and post the results to the Alumni Website and in Alumni Newsletters.

How can we trust that the Endowment Fund will be secured and used properly?

LPEAA has been successfully paying back the alumni investors (JRS) for over 20 years. That is a proven financial track record. LPEAA has 15 member board to ensure sound decisions. Additional checks/balances are being put in place to secure the Endowment Fund.

What happens if ΤΕΦ @ Clarkson ceases to exist?

LPEAA will try to recolonize for a period of up to 5 years. If LPEAA cannot start a new chapter in that time period, we would sell the Sisson Mansion, add the proceeds to the Endowment Fund and distribute the money to be used for the General Scholarship fund at Clarkson.